A mutual fund is an investing tool whereby funds from several participants are aggregated and used in a diversified portfolio of stocks, bonds, or other assets. A fund manager in charge of professionally managing this pool works to provide returns depending on the goal of the fund. Investing in mutual funds has the largest benefit in that the fund management takes care of all the complexity for you; you are not need to be a market guru.

Advantages of making mutual fund investments:

The variety of choices presented in mutual funds is one of the key factors behind their popularity. There is a mutual fund that suits your requirements whether your investing style is conservative seeking safety or risk-taking seeking great profits. Depending on your objective and risk tolerance, you might invest in debt, hybrid, equity, or tax-saving ELSS funds.

Furthermore assisting to reduce risks are mutual funds’ liquidity, openness, and diversity advantage. Your money is distributed among several assets instead of one stock or bond, therefore lowering the total loss risk. Additionally you get updates and regular statements that help you stay current with your assets and market performance.

Why Smart Choice Made from Mutual Fund SIP:

In a mutual fund, investing in mutual funds via small, consistent payments rather than lump-sum payments is known as SIP, or systematic investment plan. SIPs enable everyone, including those with barely ₹500 a month, to develop financial discipline and make investing available to everyone.

Rupee cost averaging is one of the benefits of mutual fund SIPs most especially You purchase more when markets are low; you buy less when markets are high. This helps to average the cost of investment across time, therefore lessening the impact of market volatility. This is a straightforward, stress-free approach to progressively create riches. Your SIPs can also be connected to certain objectives as home buying, education, or retirement.

How Mobile Fund Apps Simplify Investing:

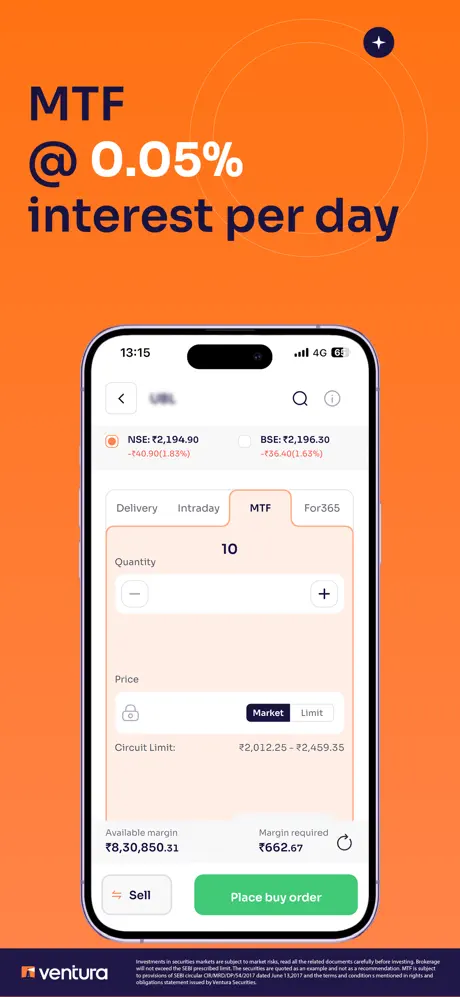

Thanks to simple mutual fund apps, technology has made starting investments quite simple. From your smartphone, these apps let you investigate several funds, set up SIPs, monitor your portfolio, and swap funds as needed. Using a mutual fund app streamlines every stage of the investment process, regardless of your level of experience with funds.

You can instantly invest, review returns, consult professional analysis, set goals, Certain mutual fund apps additionally include tools such reminders, auto-debit, and tailored fund recommendations depending on your profile. Right from the comfort of your house, a few clicks will effectively and safely manage your financial future.

Sort of Mutual Funds You Should Know:

Though they carry more risk, equity mutual funds concentrate on stocks and seek great growth. Designed for those seeking consistent returns, debt funds invest in fixed-income assets. Combining debt and equity, hybrid funds offer a harmonic investment choice. If you would prefer exposure to specific sectors like technology or healthcare, you can also investigate sector-specific funds.

Start your mutual fund adventure right now:

Mutual funds are a consistent choice whether your savings are for a dream trip, your child’s education, or long-term wealth building. Starting a mutual fund SIP and utilizing a mutual fund app can help you to take charge of your money, invest quickly and create a safe future. Start modest, keep persistent, and put your money to work for you. Your path to financial freedom becomes reachable and fulfilling with the correct strategy and instruments.