Are you looking for the most convenient personal finance option when you are facing financial strain? Well, a personal loan is what you need at that time.

When you are in a very unstable financial situation, a personal loan can help you to fund your emergency needs. A personal loan is such a monetary tool, where you can borrow money from the lender without any security or collateral fee. Usually, there are no hidden charges, either. The only thing you need to consider is choosing the way of requesting the loan amount.

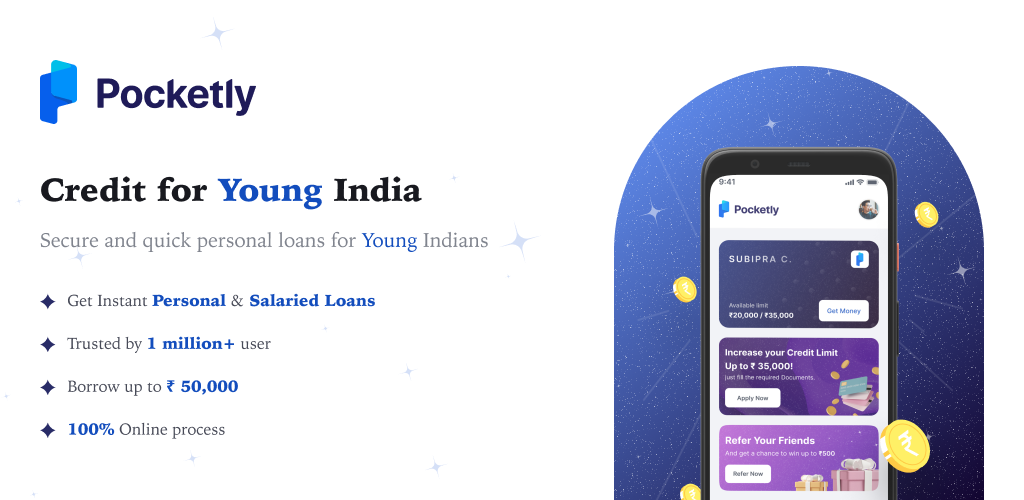

These days, online instant loans are the most reliable way to ease the financial crunch. You can apply for a personal loan or salary loan directly from your home. With less documentation and instant disbursal features, borrowers are getting attracted to this loan option. If you are convinced to apply for an instant personal loan to support your budget, you should think about where you will use your loan amount after disbursing. Here, you can find a few prominent ways to make use of your loan.

- Wedding finance: A wedding means a lot of expenses to celebrate the day to the fullest. It is only sometimes difficult to fund gold or diamond jewelry, food, venue bookings, wedding dresses, and others instantly. Personal loans from apps like Kreditbee can come in handy to manage these expenses easily.

- Debt consolidation: Instant online personal loans from apps like Nira are a great choice for debt consolidation. For example, you already have one or two credit cards where you need to repay the card bills. Usually, the personal loan interest rate is comparatively lower than the credit card interest rate. When you have the personal loan amount, you can repay at least one card bill at once. So, the higher interest rate card is paid in full. Now, the payment for the personal loan is easy to repay with flexible tenure. This is known as debt consolidation.

- Medical bills: No one expects huge medical bills. It always makes you stressed to bear the huge expenses of medicines, surgeries, and hospital fees. Especially, these days, the bills are quite pricey than in previous days. Emergency personal loans from apps like Navi, Kreditbee & more can solve this issue with instant loan disbursal.

- Travel expenses: Who does not love to travel? Literally, everyone is an avid lover, but some can not fulfill their dream of spending nights on an exotic beach because of huge costs. A personal loan amount can fund travel costs. If you have a huge bucket list to fulfill in your lifetime, take the help of a personal loan online.

- Education loan: In this age of inflation, education also requires a huge investment. A flexible personal loan can help in paying the academic fees. With a flexible repayment tenure, it is easy to repay the loan amount easily.

- Consumer durable loans: You can use your loan to purchase various consumer durables. For example, you can purchase TV, Air conditioner, Washing machines, etc with the help of a personal loan.

- Agriculture: Agriculture is a huge sector in India where major rural people are associated with agricultural work. To support their financial situation, various online loan providers offer agriculture loans where the borrower is open to using the loan amount for various agricultural purposes.

Conclusion:

Online personal loans from apps like Kissht, Nira & other such apps are not only flexible when it comes to repayment options, but also easy to apply. After applying for the loan online, you can get the loan amount within hours. You can choose your terms of repayment of the amount. Due to its huge benefits, every day, more people are choosing online personal loans for their financial needs.