Instant loans online have become a helpful financial instrument for numerous people. In any case, with this comfort comes the obligation of understanding the suggestions and overseeing funds carefully. This article will talk more about the crossing point of instant loans and financial proficiency, emphasizing the significance of educated borrowing.

The Rise of Instant Loans

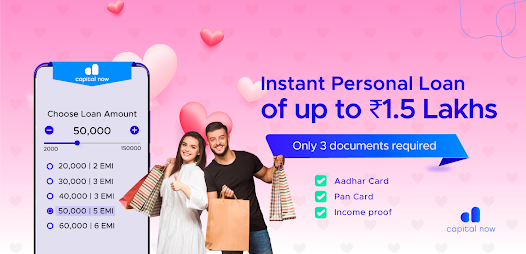

Personal loans online, frequently accessible online, give speedy access to funds without the huge application forms and approval periods related to conventional bank loans. Whether for unexpected expenses or to bridge a short financial gap, these loans provide immediate assistance.

The Appeal and Pitfalls

Whereas the charm of Instant loans may be alluring, borrowers must work out caution. High-interest rates and expenses can heighten obligations if they are not overseen accurately. Hence, understanding the terms and conditions is pivotal in committing to any advanced understanding.

Financial Literacy: A Beacon of Empowerment

Financial literacy serves as a guide, directing borrowers through the complexities of loaning practices. By preparing oneself with information about interest rates, reimbursement plans, and credit terms, people can make educated choices that adjust to their financial objectives.

Key Components of Financial Literacy

- Interest Rates: Understanding the APR makes a difference when it comes to any kind of loans, borrowers need to understand the genuine interest rate of borrowing. The next APR implies more noteworthy installments over time, affecting money-related wellbeing in general.

- Repayment Strategies: Creating the repayment strategies custom-made to one’s salary and costs guarantees convenient loan reimbursement. Lost installments can lead to extra expenses and adversely influence credit scores.

- Budgeting Skills: Successful budgeting empowers people to designate reserves admirably, prioritizing basic costs while setting aside cash for loan reimbursements. Following costs and recognizing regions for investment funds can reduce monetary strain.

Empowering Borrowers Through Education

Strengthening starts with instruction. Financial proficiency workshops, online resources, and counseling services prepare borrowers with the understanding required to explore the loaning scene unquestionably. By cultivating a culture of dependable borrowing, people can maintain a strategic distance from falling into obligation traps and accomplish monetary soundness.

The Role of Lenders

Moneylenders or loan providers play a significant part in improving financial proficiency. Straightforward loaning pratices, clear communication of terms, and dependable loaning rules contribute to a more educated borrower community. Besides, offering resources and direction guarantee that borrowers get their rights and duties, cultivating beliefs and long-term connections.

The Digital Revolution and Instant Loans

The digital revolution has significantly transformed the lending landscape, making instant loans more accessible than ever. With a few clicks, borrowers can apply for loans online through an instant personal loan app, receive instant approvals, and access funds within hours. However, this convenience underscores the need for heightened vigilance. Cybersecurity measures, verifying lender credibility, and safeguarding personal information are paramount to protect against fraud and identity theft.

Conclusion

Instant loans offer a lifesaver for people confronting different financial needs. By prioritizing financial education and understanding the complexities of borrowing, people can enable themselves to form educated choices, dodge pitfalls, and accomplish long-term financial wellbeing with the help of instant personal loan online. Remember, knowledge is control, and within the domain of instant loans, it’s the key to strengthening and money-related flexibility.